Gainful

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

Trust us as your direct lender with a modern approach! Your data stays safe, and we support you in tough times

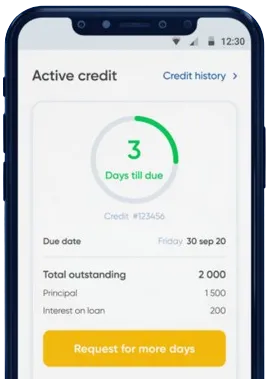

Seamless solutions in just 10 minutes from home. Instant money transfer and options to extend your loan

Enter your application details in the app by filling out the form.

Stay tuned for a decision, usually ready in 15 minutes.

Access your funds; the process usually takes just a minute.

Enter your application details in the app by filling out the form.

Download loan app

Online loans have become a popular financial solution for many Kenyans, providing a convenient and accessible way to access much-needed funds. Here are some of the key benefits of online loans in Kenya:

One of the main advantages of online loans is the convenience they offer. With just a few clicks, borrowers can apply for a loan from the comfort of their own homes or offices. This eliminates the need to visit a physical bank branch, saving time and hassle.

These features make online loans an attractive option for those who need quick access to funds without the traditional hassles of a bank loan.

Another advantage of online loans in Kenya is the competitive interest rates offered by online lenders. Many online loan providers offer lower interest rates compared to traditional banks, making online loans a cost-effective option for borrowers.

Additionally, online loans often have transparent fees and charges, allowing borrowers to understand the true cost of borrowing upfront.

Online loans also play a crucial role in supporting small businesses in Kenya. Many small business owners struggle to access traditional bank loans due to stringent requirements and lengthy approval processes.

Online loans provide a lifeline for small businesses, enabling them to access the funds they need to grow and thrive in a competitive market.

For individuals, online loans can be a useful tool for managing personal finances and emergencies. Whether it's a medical emergency, sudden repairs, or unexpected expenses, online loans provide a quick and hassle-free solution to financial challenges.

Many online lenders offer flexible repayment terms, allowing borrowers to tailor their loan to their specific financial situation.

Online loans in Kenya offer a range of benefits and are a valuable financial tool for individuals and small businesses alike. With their convenience, accessibility, competitive interest rates, and support for small businesses, online loans provide a much-needed alternative to traditional bank loans. Whether you need funds for personal emergencies or business growth, consider exploring the options offered by online lenders in Kenya.

Yes, most online loan providers in Kenya have minimal requirements such as being a Kenyan citizen, having a valid ID, and a source of income.

The approval process for online loans in Kenya is usually quick and can take anywhere from a few minutes to a few hours, depending on the lender.

The maximum loan amount varies depending on the lender, but it typically ranges from Ksh 50,000 to Ksh 500,000 for first-time borrowers.

Yes, reputable online lenders in Kenya use secure encryption technology to protect borrowers' personal and financial information. It is important to research and choose a trusted lender before applying for a loan.

The repayment period for online loans in Kenya varies depending on the lender and loan amount, but it typically ranges from 1 month to 1 year.

If you are unable to repay your online loan in Kenya on time, you may incur late payment fees and penalties. It is important to communicate with your lender and discuss alternative repayment options to avoid defaulting on your loan.